Last Friday I sent my subscribers the usual weekend report. In it I mentioned that the commercial traders were still a bit ON THE high side, with 148,000 net short positions. I told my readers that we should expect some weakness early this week, to enable these rascals to load up so they can hit us again at the next top. The weakness arrived, and the big question now is: where do we go from here?

The good news is that sharp declines usually accomplish more than one goal. They shake out the ‘weak longs', sucker in those risk-taking shorts, and in the process the market lays a firm foundation, usually near the 200DMA, from which the next ‘up leg' can start. It is important, during those ‘nail-biting' days, to look at the forest, and not at just one single tree!

In an earlier article, titled “Trading like a Pro” (available by visiting www.google.com , typing in my name, and clicking search), I listed 12 important reasons why gold will continue to rise for a number of years. Investing in gold and silver today is a lot like betting on a horse that cannot lose! To quote Richard Russell: “Those who buy the dips and ride the waves will achieve success”. Let's look at some charts. (Charts courtesy www.stockcharts.com )

|

Featured is the daily bar chart of the electronically traded Silver unit SLV. Notice the well-defined channel. The green vertical lines indicate previous buying opportunities. When SLV broke out above 14.00 two weeks ago, it caused a breakout. Breakouts are usually tested, and this one was severely tested. Today's upside reversal (blue arrow), is a sign that the test is most likely over, and we can reasonably expect the up trend to resume. Confirmation will come when price here closes above 130 (silver bullion at 13.00). ETF's appeal to pension funds and high net worth investors who are capable of ‘seeing the forest', and who do not worry too much about the ‘single tree'. More and more money is being drawn into these ETF's, instead of going into mining stocks. This is one reason why gold and silver can rise while the various mining stock indexes lag behind, instead of ‘leading the pack'. |

|---|---|

Featured is the bar chart that compares the POS to the POG. I learned during the bull market in the metals from 1976 till 1980 that during the ‘up cycle', silver always outperformed gold, and so far during the current bull market the same thing is occurring. Thus, as long as this chart is in ‘up mode', silver will continue to outperform gold, and both metals will rise. The channel is well-defined, the 50DMA is positively aligned to the 200DMA and during the past 12 months barely ‘touched' (see arrow), but never went ‘negative' |

|

|

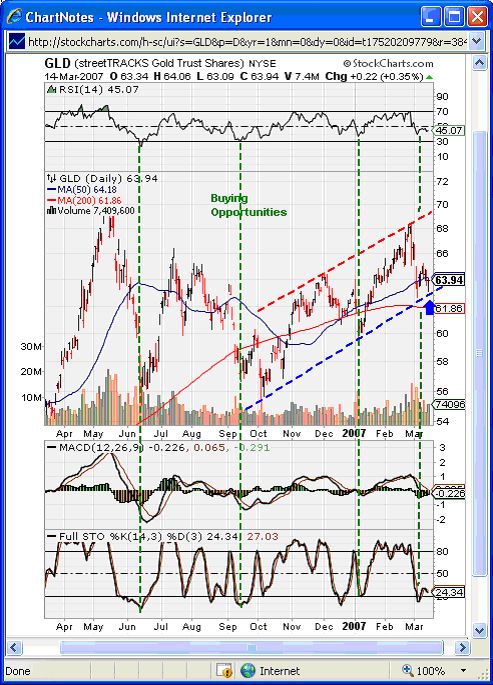

Featured is the electronically traded gold unit GLD. Notice a well defined channel. Price carved out a secondary bottom at the 200DMA today via an ‘upside reversal' (blue arrow). The 50DMA and 200DMA are in positive alignment, and in December the two moving averages carved out a golden crossover by returning to a positive alignment, all of which is bullish. Yes, they ‘do ring a bell'! The green lines indicate buying opportunities. This ETF is the world's largest, accounting for more than 80% of gold held by all of the ETFunds. According to a recent Reuters report, this ETF now holds 487 tonnes of gold! |

Featured is the HUI index of unhedged gold and silver stocks. As I pointed out earlier, I regard the movement of the SLV and GLD to be a more important aspect of my chart overall chart analysis than the various mining indexes, we do nevertheless have a positive picture here. The index carved out a bullish ‘upside reversal' near the close of business today (blue arrow), and the 50D and 200D are still in positive alignment. |

|

Summary: The world is unfolding as it should. While we cannot always get it right (since no one but God is perfect), by applying TA (Technical Analysis), to a market that has extremely bullish fundamentals, we are going to be right more often than we are wrong.

When we compare gold and silver to Uranium (up from 5.00 to 90.00); Oil (up from 10.00 to 61.00); Nickel (up from 2.00 to 20.00); Molybdenum (up from 3.00 to 27.00), and considering that gold, when its price is adjusted for inflation, needs to rise to $2,200.00 just to match its previous 1980 high of $850.00, this bull market has ‘barely begun!' South Africa and Australia are reporting a reduction in gold production. Global gold production in 2001 was 2,600 tonnes, last year total production dropped by 150 tonnes to 2,460 . Meanwhile the world's money supply is at an all time high, from 1 or 2 trillion dollars in 1996 to 5 trillion dollars last year.

For an interesting website that calculates items adjusted for inflation, why not visit www.bls.gov/cgi-bin/cpicalc.pl

(For Canadians: www.bankofcanada.ca/en/rates/inflation_calc.html)

====================================================

DISCLAIMER:

Please do your own due diligence. I am NOT responsible for your trading decisions.